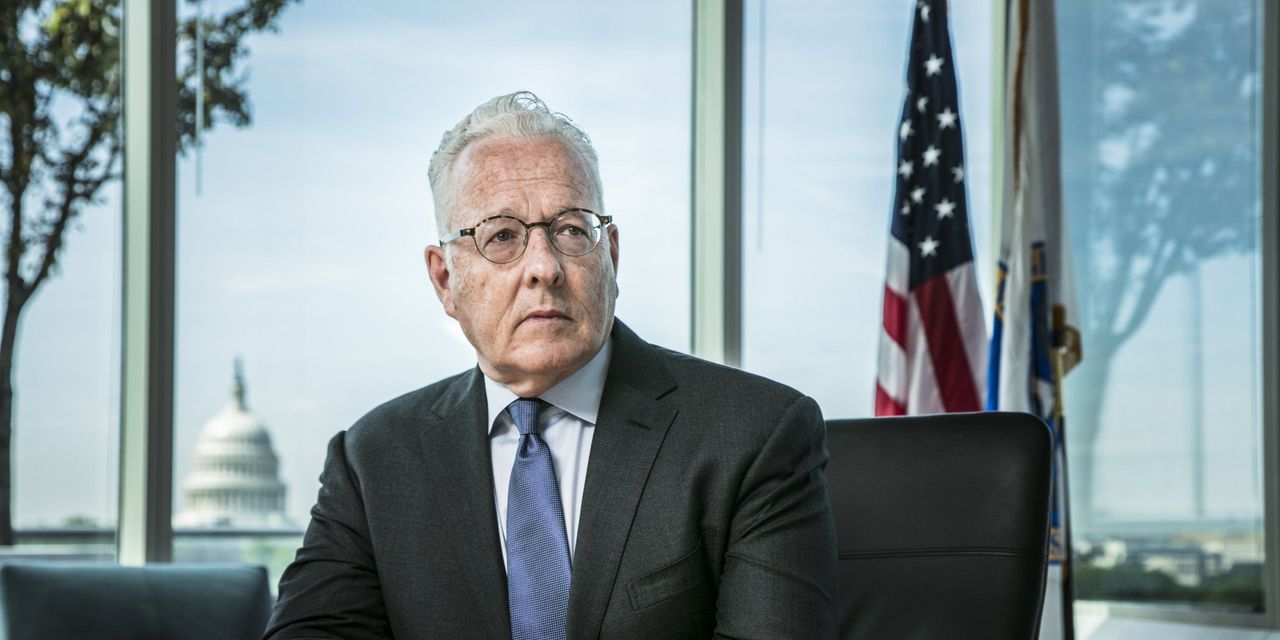

By John E. Deaton.

It didn’t just take a village. It took an army of activists, lawyers and everyday citizens to demand, insist and even sue the Securities and Exchange Commission to be transparent. From the moment William Hinman got on that stage in San Francisco on June 14, 2018, to declare that Ethereum’s native token, Ether, is not a security, something just didn’t seem right.

Indeed, that speech didn’t appear on Hinman’s official SEC calendar. The SEC has also forcefully refused under several chairman – including current Chairman Gary Gensler – to ever prejudge the status of a digital token with one very glaring exception: Hinman’s speech on Ether.

After six years, many lawsuits and tens of thousands of messages flooding into Washington, we learned today that the SEC Office of the Inspector General (OIG) is “in the final stages” of an investigation into the clear appearance of impropriety and conflicts of interest around Hinman’s speech and his many actions as SEC Director of Corporation Finance. My further understanding is that the investigation will delve into how the SEC ethics staff handled Hinman’s documented actions, or failed to.

It started with hundreds of internet sleuths working together in what I call decentralized justice. We discovered quickly that Hinman’s annual financial disclosures at the SEC showed he was receiving millions of dollars in payments from his old law firm, Simpson Thacher. We also learned that Simpson Thacher was a member of the Enterprise Ethereum Alliance, a group with the sole purpose of promoting Ethereum. Dozens of videos were located that had Hinman and other SEC officials, as well as key investors and stakeholders in Ethereum, saying in their own words what was happening in front of the cameras and behind the scenes around what Hinman called “the Ether speech”. I put them all together in a Video Library on the CryptoLaw website, and the evidence of possible conflicts of interest took shape.

At the same time, the excellent legal team defending Ripple, Brad Garlinghouse and Chris Larsen against the SEC’s lawsuit on the XRP digital token were locked in a long discovery fight over getting the internal emails and drafts of Hinman’s speech. That took years because the SEC fought so hard to hide the Hinman documents, defying so many court orders to produce them, that Magistrate Judge Sarah Netburn called them out for their lack of “faithful allegiance to the law.” As amicus counsel for 75,000 XRP holders in that case, I couldn’t agree more with Judge Netburn’s conclusion.

In August 2021, the government watchdog organization Empower Oversight jumped into the fight, with Freedom of Information Act requests and lawsuits when the SEC refused to comply. It took them years to force the SEC to produce the emails that proved how Hinman fought to receive million in payments from Simpson Thacher. They showed he was warned repeatedly he had a “criminal financial conflict” if he ever had any contact with that law firm, and he ignored them.

The Hinman emails obtained by Empower Oversight show he met over and over with Simpson Thacher, including with the head of their China office – Chris Lin – when his client had a pending IPO application before his division. The emails also showed direct contact between Joseph Lubin, one of the highest profile third party promoters of Ether, and Hinman before the 2018 speech.

In May 2022, Empower Oversight sent a referral of evidence about these conflicts to the SEC OIG. For almost two years, the group has been requesting internal communications about that referral and has been locked in litigation with the SEC to get compliance with those requests. That’s why today’s news confirming the OIG investigation is so important, and such a vindication for the thousands of people who have worked so hard to make this government agency transparent and compliant with the law.

I will not prejudge the SEC OIG’s investigation, nor should anyone else. They have pledged to give a redacted version of their final report to Empower Oversight, which means it will be made public for us to review ourselves.

But one thing is very clear. We must have our ethics rules followed by public officials like Hinman. When they are not followed, the law must be enforced. America is greatest when we have a level playing field and we allow the best technologies and innovations to compete fairly. And we must always stand up against gross government overreach.

This is the chance for the SEC to get something right for once. I hope the OIG issues a complete, fair and well-reasoned report which shows the kind of faithful allegiance to the law that the SEC Enforcement Division and Division of Corporation Finance have clearly failed to show to date.