Video Library: Did the SEC

give fair notice to XRP holders?

You be the judge.

The Securities and Exchange Commission has repeatedly insisted it has provided clarity to investors on precisely how it determines whether a digital asset is a security, therefore subject to its regulation, or not. However, it is nearly a universal perception among digital asset investors and blockchain project developers that the SEC provides no clarity whatsoever, and its public statements and actions have only generated market confusion. In turn, this has led to what many have called “regulation by enforcement.”

Many holders of the XRP digital currency believe that they were unfairly harmed by the SEC’s lawsuit against Ripple Labs and its two top executives in December 2020, which crashed the value of their holdings and led to massive panic selling, suspension of XRP trading on exchanges, and $15 billion in forced losses to retail investors. John Deaton, the founder of CryptoLaw, petitioned the court to intervene in the case on their behalf and was granted “friend of the court” status (amici curiae) by Judge Analisa Torres of the Southern District of New York. The SEC strongly opposed letting Deaton and more than 75,000 other digital asset holders participate in the case, arguing that all XRP holders should have known that XRP – which operates on a fully decentralized, open-source ledger – was a security from 2013 until present day.

In response, these investors have crowd sourced a wealth of evidence that supports their conviction that the SEC failed to provide fair notice to the markets, and instead fostered market confusion which allowed for picking winners and losers rather than providing equal protection to all investors. Furthermore, in this climate of market confusion, the evidence suggests unfair advantages were granted to insider investors by senior SEC officials with conflicts of interest.

This video library is a chronological document of what the SEC and key market participants said publicly in their own words before, during and after the SEC’s enforcement action on XRP.

Judge for yourself if you see fair notice, a level playing field and regulatory clarity here.

[Last Update: February 23, 2023.]

Joel Dietz and Vitalik Buterin, Bitspace 360

Joel Dietz, co-founder of Ethereum, leads a pre-launch presentation on Ethereum, specifically on the “technology and then organizationally, including this IPO.” Dietz goes on to describe the legal structure of Ethereum as “up in the air” but that it “is going to have a few different non-profits who are established in different parts of the world.” He then describes the fundraising as “crowd equity funding” and says that there “would not be a cap on per person [purchasing]” and that there “is no way to know who is contributing.” Later on in the presentation, Ethereum founder Vitalik Buterin admits “the SEC is a tough thing” and that “we do have to be careful” when talking about the “Ethereum IPO”.

Source: @gg_scaramanga

Joseph Lubin, Silicon Valley Ethereum Meetup

When asked “will there be a limit on the amount a person can invest in Ethereum” Joseph Lubin – co-founder of Ethereum – responds shortly before the ICO: “A person can buy from any number of different identities. We may limit the size the unit size of a sale just to make it easier to disguise.” For investors who “want some privacy” and are “planning on investing several million U.S. dollars worth, then you can do that in multiple identities.” Lubin assures that Ethereum “won’t be requiring” a “real world identity” for sales of ether. “We can create a pseudonymous email and identity on purchasing,” he pledges.

For whales, anyone “planning on investing several million U.S. dollars’ worth,” Lubin recommends to “do that in multiple identities” and says that “we will ask for real world identity in the form of an email address just so that we can make sure that everything works smooth.”

Source: @_XRpizza

Vitalik Buterin, Texas Bitcoin Conference

In describing the upcoming initial coin offering (ICO) for Ethereum, Vitalik Buterin insisted it would be “an opportunity for anyone to purchase ether” which he said was a “currency inside the Ethereum system, sort of like the XRP in Ripple.”

The ICO was launched on July 22, 2014.

Source: @digitalassetbuy

Jay Clayton, Senate Banking Committee confirmation hearing

Jay Clayton is questioned by Sen. Elizabeth Warren (D-MA) over how he would be barred from voting on the SEC on matters involving clients of his law firm, Sullivan & Cromwell

Source: @Jungleincxrp

ConsenSys is “Building an Alliance” with SEC

Matt Corva says Joseph Lubin’s company, ConsenSys – a client of Sullivan & Cromwell, Jay Clayton’s law firm — has been “building an alliance with other blockchain companies, law firms…and regulators. We’ve had some talks with the folks at the SEC.” He is referring to the Enterprise Ethereum Alliance founded in 2017, which also includes Simpson Thacher & Bartlett, the law firm of SEC Director of Corporation Finance William Hinman. The Alliance’s mission is “to drive the use of Enterprise Ethereum”.

Source: @digitalassetbuy

Joseph Grundfest and Jay Clayton, Stanford Law Rock Center for Corporate Governance

Former SEC Chairman Grundfest says to Jay Clayton “you’ve gone after only three (ICOs) when there are hundreds that look almost identical, why?” Jay Clayton responds by saying “I think that the three offerings we have gone after in the 21A report make it pretty clear to people what we think is permissible and not permissible” and that “if the market continues as it is those will not be the last enforcement actions.”

Source: @sentosumosaba

Steven Nerayoff, Industry Perspectives: The Blockchain event

Steven Nerayoff says that Ethereum’s lawyers told him that they had an “illegal securities offering.” He then said that he “was charged with a very simple thing. Raise money, and not go to prison.”

He also says that he described his plan to frame ether as a good to former SEC chairman Joseph Grundfest who thought it was “brilliant” and that he “spoke to some folks at the SEC who actually loved the idea and thought it made a lot of sense.” He describes this as the genesis of “the concept of a ‘utility coin’.”

Source: @digitalassetbuy

Brad Garlinghouse, Bloomberg Markets

Ripple CEO Brad Garlinghouse explains the company’s interbank messaging system for cross-border payments, competing with the existing SWIFT. He says Ripple has over 100 customers ranging from some of the biggest banks in the world to payment providers.

Source: @digitalassetbuy

Investors Meet SEC, Ask for Free Pass on Ether

Andreessen Horowitz organizes a meeting of Ethereum investors and lawyers with the SEC to lobby for a free regulatory pass to ether, which was launched with an ICO in 2014 and has been sold in large quantities to investors for speculative purposes afterwards. Nathaniel Popper, a reporter for the New York Times that reports the story, tweeted that the Andreessen Horowitz venture capital working group “quietly met” with the SEC to suggest that “some virtual currencies be protected from the dreaded status of being a security”. Popper adds in another tweet that “regulators have indicated in private meetings” they were considering a free pass specifically for ether.

A participant in the meeting, Nancy Wotjas, later confirmed that it was a group of Ethereum investors and a member of the Enterprise Ethereum Alliance, the law firm of Perkins Coie, gave the SEC the written proposals that the New York Times quoted as seeking a free pass for ether.

All documentation, reporting and subsequent retelling of events from those in the room (as detailed in this Video Library) indicate that ether was the sole digital asset discussed for a regulatory free pass in these “quiet” and “private” meetings between Ethereum investors and the SEC.

Sources: The New York Times; @digitalassetbuy

Gary Gensler, MIT Business of Blockchain

Then-former CFTC Chairman Gary Gensler says there is not regulatory clarity in the digital asset markets, and “for Ripple” there “needs to be clarity in the market.” He then scoffs that “a group of venture capitalists that went in to the SEC” and how “they’re sort of saying – believe us, we get you, we’re with you, SEC – but we have a bunch of clients who are going to evolve to be a consumable token … I kind of don’t think this is going to work.” Gensler concludes by saying that “the market needs clarity” and that “the uncertainty as to whether ether is or is not a security… it could exist for months but at some point in time it is worthwhile to settle that down or have it fall into the courts.”

Sources: @Leonidas, @RealXRPboy and @XRPeople4

Hinman Exchange with Rep. Tom Emmer

At a House Financial Services Committee hearing, Rep. Tom Emmer (R-MN) asks SEC Director of Corporation Finance William Hinman for a specific definition on when a token is not a security. They discuss the definition of a “utility token” which does not fit the description of ether. Emmer asks what projects can do to “improve regulatory clarity” to prevent “enforcement actions by the SEC”, and Hinman replies that the SEC is “meeting with participants” with tokens that “they believe shouldn’t be regulated as a security and we work through with them how that may be structured.”

Source: @CryptoLawUS

Robert Jackson, CNBC

SEC Commissioner Robert Jackson says Chairman Clayton “has not seen an ICO that is not a security”.

Source: @digitalassetbuy

Charles Gasparino report on Brooklyn Project, Fox Business

Charles Gasparino of Fox Business has spoken to “major players in the cryptocurrency and blockchain industry” who are “coming together with a consensus” on an “organizational route” to ensure that “anything that is traded inside their blockchain to be considered a currency” and “given legitimacy”. He cites the Brooklyn Project, started by Joseph Lubin and figures linked to Ethereum, who “have a lot of friends on Wall Street.”

Gasparino also tweets that Lubin’s effort “seeks to create the first Self Regulatory Organization sanctioned by

@SEC_Enforcement”. The Brooklyn Project then tweets a “big correction”: “Not SEC sanctioned, and no current plans for a sanctioned organization.” Gasparino replies that he’d been told what he reported. This was about one month before the Hinman speech.

source: @digitalassetbuy

Joseph Lubin, keynote address at Ethereal Blockchain Conference, New York

Lubin says that “we need mechanisms” to allow for fundraising and token sales “despite the fear, uncertainty and doubt you’ve heard over these many months, we are making great strides in helping the people that make those decisions understand…”. This was one month before the Hinman speech.

Source: @BakkupBradley

Joseph Lubin, Fluidity Summit

One month before the Hinman speech, Lubin (after doing his “legal homework”) says ether was “never a cryptocurrency” and sold “very explicitly to software developers, to people who intended to use the system” and “not sold for speculative purposes.” He says “it never was a security.” (In fact, Ethereum co-founder Vitalik Buterin advertised the 2014 ICO as “an opportunity for anyone to purchase ether” which was “a currency inside the Ethereum system sort of like the XRP in Ripple.” Buterin also structured a sale of 500,000 ether tokens to Lubin’s college friend Mike Novogratz in 2015, which he said made him a hefty profit on the secondary market.)

Source: @digitalassetbuy

Tom Lee, CNBC

Tom Lee (ex-JP Morgan) makes elliptical comment that the SEC will declare that ether is not a security, causing a confused CNBC host to ask for him to explain. (Did Lee see a draft of Hinman’s speech?)

Source: @digitalassetbuy

Joseph Lubin, Viva Tech conference in Paris

Joseph Lubin of ConsenSys and co-founder of Ethereum says “we are able to issue” tokens that are not securities and describes apparent details of the Hinman speech almost a month before it is made.

Source: @digitalassetbuy

Gary Gensler, Maryland Senate Committee

Gary Gensler says, “there is a strong legal case” that ether is a security. “They were careful, they were clever, but they still, I think, were a duck and waddles and quacks like a duck.”

Source: @TAIGxrp

Michael Novogratz, Bloomberg

Mike Novogratz, with whom Vitalik Buterin arranged a purchase of 500K ether tokens for speculative purposes in 2015, says “I bet dimes to donuts” that the SEC will say that ether “probably was a security but it isn’t anymore.” This was nine days before the Hinman speech (Did Novogratz see a draft in advance?)

Source: @digitalassetbuy

Jay Clayton, CNBC

Jay Clayton confirms that he sees most ICOs are securities. The host asks whether the SEC is “planning now to make a clear statement on that” and Clayton replies: “Bob, I hope I just did.”

Source: @Jungleincxrp

Brett Redfearn, CNBC

Brett Redfearn, SEC Director of Division of Trading and Markets and former senior JP Morgan executive is confronted with market confusion over the SEC’s regulatory approach to crypto. Redfearn concedes that “when looking at these issues, that it’s not as obvious as you would think” and encourages “market participants” to interpret the Howey Test as a guide. Both Ripple and Coinbase later followed that guidance, and concluded that XRP was not a security under the Howey Test.

Redfearn is asked about whether XRP or ether are securities, and he replies that the public should expect “statements about one of those products forthcoming in the future providing more guidance”. This was 7 days before the Hinman speech.

Source: @digitalassetbuy

Alfred Browne of Cooley LLP, Boston College Finance Conference

Browne co-chairs the fintech practice of Cooley LLP, which participated in the drafting of recommendations to William Hinman that were incorporated into his speech about Ethereum. Here Browne states there is a “pretty healthy debate” as to whether XRP or ETH are securities. “The industry is struggling” over whether tokens are securities, he said, and that after November 2017 after a jump in BTC purchases, the SEC was indicating that even bitcoin “might be a security.”

“It really is a very difficult regulatory environment right now in the U.S.,” Browne said. “I think most of the market participants are hoping for a little more clarity.”

The Hinman speech, telling the markets that “putting aside the fundraising associated with the creation of ether … we believe that current offers and sales of ether are not securities transactions,” was one week later.

Source: @digitalassetbuy

Joseph Lubin Interview

Joseph Lubin, co-founder of Ethereum and founder of ConsenSys, says that “we certainly need bodies like the SEC to scare many projects straight.”

Source: @digitalassetbuy

Joseph Lubin on his ETH “framework” with the SEC

Joseph Lubin, co-founder of Ethereum, describes how “we have a framework that enables us to sell consumer utility tokens, not in enormous quantities, not with discounts for large investors” and that purchasers “have to be accredited” and “demonstrate you will use these tokens on these platforms”. (Lubin does not mention that 500,000 ether tokens were sold in a private transaction to his college roommate, investor Mike Novogratz, in 2015. Novogratz said he later sold them at an enormous profit.)

Source: @digitalssetbuy

Jeff Pulver, Distributed: Markets 2018

Jeff Pulver, Vice Chairman of Alchemist, says attorney Steven Nerayoff “is the one responsible for getting the letter that said that Ethereum is not a security”. This was one day before the Hinman speech.

Source:@NerdNationUnbox

All Five SEC Commissioners, Atlanta Town Hall

In the presence of all the commissioners of the SEC, Abraham Xiong of the Blockchain Chamber of Commerce, who says “there is not a lot of clear guidance” on blockchain technology from the SEC, and asks for an “official position” from the commissioners. Chairman Jay Clayton insists that “we have had very clear rules on how to conduct fundraising” and that “most of what I’ve seen in the ICO space is a securities offering. It is raising money for a project where I give you my money, you give me some type of write-back that reflects a return on your project. That’s a securities offering. And I don’t know how much more clear I can be about it.” This was one day before Hinman’s speech.

Source: @CryptoLawUS

Hinman Deputy Amy Starr, Atlanta Town Hall Meeting

The SEC’s chief of capital markets trends at the Division of Corporation Finance, Amy Starr, says that if a token is “literally something that you are buying and you are only going to use it on an already existing platform, that you are buying to use, then I would say, “hey, that token is a use token” which may not have the characteristics of a security.” (This has been the experience of thousands of XRP purchasers and XRPL developers who would later be harmed in the filing of the SEC v. Ripple lawsuit in December 2020.)

This was one day before Hinman’s speech.

Source: @RaethonM

The Hinman Speech

The speech by William Hinman at the Yahoo Finance All Markets Summit which declares that “putting aside the fundraising” of Ethereum’s ICO, ether is not a security.

Hinman then commented on his own speech moments after giving it, saying that the speech was given because “the chairman and the SEC” felt they had to “be clearer” and “transparent” and give “guidance” about ether.

Hinman is also asked by the moderator about his mention of ether: “Is the takeaway that these are not securities then?” Hinman answers: “Right. I think the takeaway and maybe the news is more on the ether side.” This makes it clear that Hinman was well aware during the drafting of the speech that his mention of Ethereum would be noticed by the news media and the markets.

The SEC’s legal staff has frequently cited this speech to affirm in official SEC legal documents that “the Commission has publicly recognized Ethereum and its native currency Ether.”

Court filings indicate drafts of the speech were attached to at least 63 SEC emails before it was final, involving at least 38 senior SEC staff members in the drafting process.

After suing Ripple, the SEC and Hinman disowned this speech as being market guidance from the SEC, arguing it was only Hinman’s “personal opinion”.

Sources: BankXRP, @CryptolawUS and @Leerzeit

Andy Serwer and Michael Sonnenshein, Yahoo Finance Summit

The moderator who had just spoken with William Hinman about his speech has event organizers post the real-time trading price of ether, which was up significantly. “You see over there,” Serwer tells the audience. “That was after the comments by the SEC. Interesting market action there, right? Um…whoa!”

“News like this moves markets,” added Sonnenshein, the CEO of Grayscale Investments.

Source: @Leerzeit

Joseph Lubin and Josh Constine, Yahoo Finance Summit

Shortly after Hinman’s speech, Lubin appears on the same stage. He claims he “wasn’t able to read through Bill’s entire speech” but asks Constine if Hinman “spoke about XRP at all?” Constine says he didn’t, and Lubin replies: “That’s interesting.”

Source: @digitalassetbuy

Valerie A. Szczepanik, Capitol Crypto

SEC Senior Advisor for Digital Assets and Innovation Valerie A. Szczepanik, at a Washington, D.C., event hosted by Mitchell Silberberg & Knupp on Capitol Hill, says: “I think a lot of guidance will be given out in speeches and statements because we’re not trying to regulate a situation that’s hypothetical.”

That same day, William Hinman gave his speech declaring ether is not a security. After the SEC sued Ripple in 2020, Hinman and the agency then claimed in court that the speech was his personal opinion and not market guidance.

Source: @Nosemaj555

Bill Hinman, CNBC interview

On the same day as his speech at the Yahoo! Finance Summit, William Hinman explains to CNBC that “when we look at ether” — ‘we’ clearly meaning the SEC — “we don’t see a third party promoter where applying the disclosure regime would make a lot of sense.” He goes on to describe securities transactions made with tokens that, in fact, closely describe the Ethereum ICO of 2014, the promotion of ether by Vitalik Buterin, Joseph Lubin and the Ethereum Foundation, and ongoing promotion by Lubin’s company, ConsenSys.

Court documents in the Ripple case and Hinman’s redacted public calendar revealed that Hinman or his advisers met exclusively with Lubin and ConsenSys seven times before Hinman gave his speech, and no promoters or developers of any other ledger or token.

Source: CNBC

Tim Draper and Gary Gensler, BEF

Venture capitalist Tim Draper tells Gensler that bankers are “panicking right now” about crypto’s disruptive potential, and predicts legacy finance players will sue, exert media pressure and leverage government regulators to try to slow its progress. This was six days after the Hinman speech.

source:@CryptoLawUS

Warren Davidson, CNBC

Rep. Warren Davidson (R-OH) indicates his impression that Hinman’s speech was market guidance on how the SEC will regulate crypto.

Source: @digitalassetbuy

Brad Garlinghouse , Future of Fintech 2018

Ripple CEO Brad Garlinghouse notes that Coinbase had announced two days before the Hinman speech that they were listing Ethereum Classic.

Source: @digitalassetbuy

Joseph Lubin and Dominic Chu (CNBC), Future of Fintech 2018

Days after the Hinman speech, a jubilant Lubin says he believes competitor Ripple is “massively overvalued”.

Source: @digitalassetbuy

Wall Street’s Crypto King Bart Smith on @CNBCFastMoney

Smith shows the market perceived that Hinman’s speech was market guidance that ether is not a security, and he adds that Hinman “left out” that other tokens didn’t meet the same criteria.

Source: @digitalassetbuy

Kyle Samani, Fortune’s “Balancing the Ledger”

Kyle Samani of Multicoin Capital – of which Chris Dixon of Andreessen Horowitz was a Limited Partner – says he is shorting XRP “based on the SEC’s guidance … about ether not being a security, it’s quite clear to us that Ripple is a security.” He adds that Multicoin has “very high conviction” that it [Ripple] is a security, but they “do not know when that news will drop”.

Source: @digitalassetbuy

Joseph Lubin, Crypto Valley

In response to a discussion about “why we would we be selling unregistered securities to Americans,” Ethereum co-founder Joseph Lubin says: “I drove lots of the legal work. We got a piece of paper in our pocket before we actually launched the token sale.” Ethereum held an ICO for its digital token, ether, in 2014.

Source: @digitalassetbuy

Joseph Lubin RISE 2018

Joseph Lubin says Hinman’s speech contained “very interesting things about consumer utility tokens” – despite Hinman never using that term in his speech – and insists that the U.S. “does have regulations” for crypto.

Source: @digitalassetbuy

Mike Novogratz, #Hashed

Mike Novogratz discusses first buying into Ethereum saying that he “bought Ethereum from Vitalik at 96 cents” but soon realized that “Joe (Lubin) no longer needed my money” so he decided to become “a private investor.”

Source: @digitalassetbuy

Michael Novogratz, Seoul Beyond Blocks Summit

Hedge fund investor Mike Novogratz says ConsenSys founder and Ethereum co-founder Joseph Lubin was a college roommate of his and is “a wonderful source for me and we collaborate,” adding that he is “talking to enough people in the ecosystem who are talking to the regulators every day.”

source: @digitalassetbuy

Joseph Lubin, Hidden Forces podcast

Two months after the Hinman speech, Joe Lubin of Ethereum says “we got a lot of pretty high quality clarity, in my opinion” from the SEC. He adds that Jay Clayton “indicated they wouldn’t be grandfathering anybody in” and that “the securities law issues are pretty close to resolved” and “I think there are going to be some bad times for some projects going forward”. His “thesis” is that the SEC “doesn’t want to kill blockchain” and that it will do so entirely through “positive statements” about bitcoin and Ethereum.

Source: @digitalassetbuy

Jesse Powell at Distributed 2018: Navigating Crypto Exchanges

Jesse Powell, the CEO of Kraken crypto exchange, clearly indicates market perception that Hinman’s speech was SEC market guidance that lacked clarity beyond bitcoin and ether not being securities.

Source: @digitalassetbuy

Jay Clayton, Nashville 36|86 Entrepreneurship Festival

Two months after the Hinman speech, SEC Chairman Jay Clayton says that “Bill Hinman recently outlined the approach we take to evaluate whether a digital asset is a security.” He adds: “I encourage you to take a look at Bill’s speech which is available on our website.”

Despite the fact that Clayton clearly said “we take” – meaning the SEC – the subsequent SEC transcript of this speech tampered with the truth, changing “we” to “staff.”

Source: @NerdNationUnbox

Joseph Lubin Warns of “Reckoning Coming”, Firstmark

Joseph Lubin, co-founder of Ethereum, after ether obtained its regulatory pass, warns of “a reckoning coming” from the SEC for “certain projects.”

Source: @digitalassetbuy

Joseph Lubin Reframes Ether as “Consumer Utility Token”, Firstmark

Joseph Lubin, co-founder of Ethereum, describes ether as a “new way of organizing for collective action” since its purchasers are “forced to pledge” or “constrained” to “using the token on the network” and cannot speculate on them for profit.

Source: @digitalassetbuy

Gary Gensler, Peterson Institute

In a speech before the Peterson Institute for International Economics in Washington, D.C., Gensler calls XRP “a currency … in the banking sector.”

Source: @WillyWonkaXRP

Lowell Ness of Perkins Coie, BlockCon 2018

Lowell Ness of Perkins Coie reveals something “that not a lot of people know” — a meeting between Jay Clayton and Andreessen Horowitz played a central role in later events.

Ness says that after appearing at a Stanford University event in January 2018, Jay Clayton “made his way over to see Andreessen [Horowitz] the next morning, and he invited Chris Dixon [partner, Andreessen Horowitz] to round up the industry players” and asked for “a proposal on where to go from here”. Ness had been representing Andreessen Horowitz “on all their crypto investments since the beginning” and “I got the chance to write all that stuff.”

Ness said the “general reception” from the SEC when those meetings began “were really positive.” He adds “it was an interesting dichotomy between their public facing incredibly vituperative statements that they were making and this interesting welcome that we got privately.”

Source: digitalassetbuy

Vitalik Buterin and Joseph Lubin, The New Yorker

Reporter Nick Paumgarten profiles Ethereum and ConsenSys. He interviews Vitalik Buterin, who boasts of how “someone who has high status inside a cryptocurrency community” becomes a “high priest” who can “issue fatwas.” Lubin, in turn, explains that he escaped having ether be seen as an unregistered security by “creating a reality” through words. He said they “defined what Ethereum is and what ether is” and that “we could create reality that way. It seems to have worked.”

Source: @digitalassetbuy

Nancy Wojtas, Texas Bitcoin Conference

Nancy Wojtas of Cooley LLP, who participated in the drafting of the Venture Capital Working Group proposals to the SEC in March 2018, disagrees with William Hinman that ether is sufficiently decentralized to not be a security. Co-panelist Wendy Moore of Perkins Coie adds: “Then why isn’t Ripple?”

Wojtas continues her criticism of Hinman’s actions: “There is no question. Ethereum violated the law in the SEC’s view when it issued its tokens…but then [Hinman] said, look, the securities laws don’t add anything now because ether is decentralized.”

Source: @digtalassetbuy

Bill Hinman, Georgetown Law Fintech Week

Bill Hinman makes clear his June 2018 speech was market guidance from the SEC, not just from him: “It was the first that that we expressed to the world that we didn’t view ether as a security as it was then currently being offered.” Again referring to the speech, he said “we also, last summer, spoke a little bit more about how we were looking at” ether and bitcoin, and “we made it very clear that we don’t see a reason to regulate those as securities.”

Source: Professor Chris Brummer (YouTube)

Steven Nerayoff, The Decentralisation of Centralised Services

Ethereum lawyer Steven Nerayoff says that he is “very fortunate because the first ICO that I was involved in was Ethereum” and that he “was charged with coming up with a legal structure for the ether crowd sell.”

Source: @digitalassetbuy

Joseph Lubin, DLD 19

Joseph Lubin says “we are big friends and fans” of the SEC and praises its application “of something called securities law”. He adds that the SEC has “introduced a new construct called decentralization” into their regulatory thinking, mentioning that they see bitcoin and ether as “decentralized” and that “no transactions involving those particular assets are considered to be” securities. But mentions that “they have not said the same about other tokens” – specifically XRP – claiming to know that the SEC is not going to find any token other than bitcoin and ether to be decentralized, dropping in Hinman’s name.

source: @digitalassetbuy

Patrolling the Block: Regulators Panel at DC Blockchain Summit 2019

SEC Senior Advisor for Digital Assets Valerie Szczepanik describes how the SEC defines whether a digital asset is a security.

Source: Chamber of Digital Commerce

Robert Jackson, New York Financial Writer’s Association

Former SEC commissioner Robert Jackson discusses SEC’s position on securities laws in relation to cryptocurrencies, saying “we just put out some guidance on this.” He then points to Hinman’s Yahoo Finance Summit speech as guidance, saying “the most helpful thing I think, our director of corporation finance Bill Hinman gave a speech about a year and a half ago that describes this.”

Source: Media NYAIR

Gary Gensler, Harvard Law School

Gensler says there is a test he likes “better than the Howey Test”, which goes: “It quacks like a duck, it waddles like a duck, it talks like a duck, it’s a security.”

Source: @ISO_XRP

Joseph Lubin, Investopedia

Joe Lubin co-founder of Ethereum admits that “according to legal analysis at the time we conducted the sale (of ether), it failed a prong of the Howey test.”

source: @ISO_XRP

Michael Hoke, Senior Counsel SEC

Michael Hoke, Senior Counsel at U.S. Securities and Exchange Commission points to William Hinman’s June 2018 speech as guidance.

Source: @digitalassetbuy

Robert Jackson, CBinsights

SEC Commissioner Robert Jackson makes it clear that Hinman’s June 2018 speech was guidance to the market, using the word “we” multiple times and saying the speech “gave a set of principles that the market can follow.”

Source: @digitalassetbuy

Former SEC Counsel Nancy Wotjas Reveals Hinman Speech Lifted from ETH Document

Nancy Wotjas of Cooley LLP, former counsel to the SEC Chair, reveals she participated in the March 2018 meeting organized by Andreessen Horowitz, where a proposal written by the law firm of Perkins Coie, a core member of the Enterprise Ethereum Alliance, was submitted asking for a free pass for ether. She adds that “most of” Hinman’s June 2018 speech was lifted from that proposal and “meetings that we had.”

Wotjas adds that the SEC later told her it disagrees with Hinman’s speech that tokens are mutable and can change. She also suggests entrepreneurs should fight the SEC, which is “determined to make their life hell.” She warns that ‘if we want to lose blockchain to the Russians… continue on this course,” and says the SEC is “creating regulation by enforcement.”

Source: @digitalassetbuy

Vitalik Buterin and Joe Lubin, Ethereal Tel Aviv

Ethereum co-founder Joseph Lubin admits that from Ethereum’s launch through the time he was speaking, “we needed to put out something that we knew was not scalable” and that they needed to “figure out the developer tooling and the infrastructure that we needed to build them.” He adds: “We knew it wasn’t scalable, for sure.”

source: @Coin_casher

Joe Lubin, Devcon5

Ethereum co-founder, Joe Lubin, speaks on EOS – an Ethereum competitor. He discusses how the “SEC recently gave the EOS project a slap on the wrist for its token sale.” He goes on to add that in spite of that the SEC would “shut down a sale structured like the EOS sale today before it could put up its first billboard.”

Source: @Leerzeit

SEC Commissioner Robert Jackson Talks to Market Participants

SEC Commissioner Robert Jackson tells a meeting of market participants says that Hinman’s speech was market guidance, and that the SEC is regulating ad hoc instead of conducting formal rulemaking, since any formal rule could become obsolete in a matter of months. He describes the lack of clarity and ad hoc guidance as a deliberate strategy set forth by Chairman Jay Clayton.

Source: @digitalassetbuy

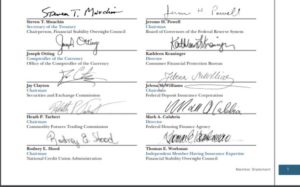

Jay Clayton Endorses XRP as a “Currency”, Financial Stability Oversight Council Annual Report

The Financial Stability Oversight Council’s 2019 Annual Report is issued, which classifies XRP as a “currency”. Jay Clayton, as Chairman of the SEC, voted to approve the report and signed it.

Source: @BakkupBradley

Vitalik Buterin and Eric Weinstein

Ethereum co-founder Vitalik Buterin says during an interview “I did get the Ethereum Foundation to sell 70,000 Eth like basically at the top and that’s doubled our runway now.”

Source: @digitalassetbuy

Joseph Lubin, Cointelegraph China Blockchain Week

Joseph Lubin falsely claims “there are only two decentralized protocols on the planet right now that are sufficiently secure enough and decentralized enough so that they can be trusted. Those are Bitcoin and Ethereum.” Lubin adds that Bitcoin is too difficult to program, and therefore for all developers of “value tokens”, Ethereum is “the only game in town.”

Source: @digitalassetbuy

Joseph Lubin, Forkast.News Interview

In an interview with Forkast.News on ConsenSys’ acquisition of Quorum, Joe Lubin, co-founder of Ethereum and founder of ConsenSys says “ConsenSys and JP Morgan have been very friendly and collaborative for quite some time…we’ve interacted with them roughly from the start. We started to interact with them in a really concerted way around the time of the advent of the Enterprise Ethereum Alliance. We were two of the major drivers of that initiative and have been two of the major drivers of activity inside the EEA since launch.”

ConsenSys was advised in its Quorum acquisition by Sullivan & Cromwell, SEC Chairman Jay Clayton’s former law firm. This was four months before the Ripple lawsuit was filed by the SEC.

Source: @ISO_XRP

Joseph Lubin, Unconfirmed with Laura Shin

ConsenSys founder Joseph Lubin describes his Quorum acquisition’s offering, an “interbank information network” that is “similar to what SWIFT does” and works with “north of 400 financial institutions around the world”. He adds that ConsenSys supports JP Morgan’s own stablecoin, JPM Coin.

Source: @digitalassetbuy

Joseph Lubin, Outlier Ventures Founders of Web 3

Joseph Lubin admits his “regulatory advantage” stating, “Bitcoin and Ethereum arrived before regulators were paying attention” and that “we were fortunate enough to frame our token as a utility token.” He goes on to say that now “regulators are watching so pretty much all the tokens need to be introduced to the world in a convoluted fashion or are really just going to be seen as securities.”

Source: @digitalassetbuy

Jay Clayton, Economic Club of New York

Jay Clayton says that “the area [of crypto] that is of particular interest to me … is the payment system. Our payment system is inefficient. Domestically it is inefficient. Internationally it is extremely inefficient. So if we don’t work and use technology to address those inefficiencies the market is going to do it for us.” One month later, Clayton’s SEC sued the highest profile market leader providing a solution – Ripple – at a time ConsenSys was moving to directly compete with Ripple.

Source: @milerman50

Vitalik Buterin, Coinbase Speaker Series

The creator of Ethereum tells Coinbase CEO Brian Armstrong how “we” are “getting rid of” the network’s proof of work mechanism to replace it with one “entirely based on proof of stake”. He adds that this transition depends on Ethereum’s users “abandoning the $50 billion base layer that they know and love and move to the one we consider better. It’s still a leap that people have to take.”

This was one month before the SEC filed the Ripple lawsuit.

Source: @sentosumosaba

SEC Sues Ripple, Garlinghouse and Larsen

On the last day of Jay Clayton’s tenure as SEC Chairman, the SEC files its bombshell enforcement action against Ripple Labs and its two senior executives, alleging that XRP has been an unregistered security since 2013. The price of XRP plummets and exchanges begin to suspend trading, causing panic selling and a loss of $15 billion in value to retail investors and project developers using the XRP Ledger. The SEC would go on to allege in its amended complaint that XRP has no utility other than as an investment contract in Ripple, and all market participants should have known it was a security from 2013 to the present date. (Unlike with ether, there was never an ICO for XRP.)

The SEC would later attempt to disown any notion that the June 2018 Hinman speech represented market guidance of any kind and was merely his personal opinion. In an affidavit supporting the SEC’s motion to stop him from being deposed in the case, Hinman said that speech “was intended to express my own personal views.” (The motion failed, and the judge ordered Hinman to be deposed.)

The SEC was also forced to admit in court that it had never opened an investigation into whether ether was an unregistered security. Ether was issued in an ICO and later sold in enormous sums by the Ethereum Foundation for speculative purposes to investors, including Joseph Lubin’s college roommate.

Clayton Joins One River Asset Management

Now-former SEC Chairman Jay Clayton is hired by One River Asset Management, a crypto hedge fund that “quietly” made a huge financial bet exclusively on the two assets named in Hinman’s 2018 speech – bitcoin and ether. One River’s $600 million position in BTC and ETH, according to Bloomberg, was completed a few weeks before the Ripple lawsuit was filed.